This decision could pave the way for new investment products that further impede efforts to meet our climate goals. Before jumping on the Bitcoin ETF bandwagon, financial institutions need to do their due diligence on Bitcoin’s climate risk and its disastrous impact on communities.

Bitcoin consumes as much electricity as entire countries, and 62% of the electricity used for Bitcoin mining globally in 2022 came from fossil fuels. Bitcoin’s energy-hungry technology has revived decommissioned coal-fired and fossil fuel power plants and caused substantial environmental and social damage.

This decision could pave the way for new investment products that further impede efforts to meet our climate goals. Before jumping on the Bitcoin ETF bandwagon, financial institutions need to do their due diligence on Bitcoin’s climate risk and its disastrous impact on communities.

Bitcoin consumes as much electricity as entire countries, and 62% of the electricity used for Bitcoin mining globally in 2022 came from fossil fuels. Bitcoin’s energy-hungry technology has revived decommissioned coal-fired and fossil fuel power plants and caused substantial environmental and social damage.

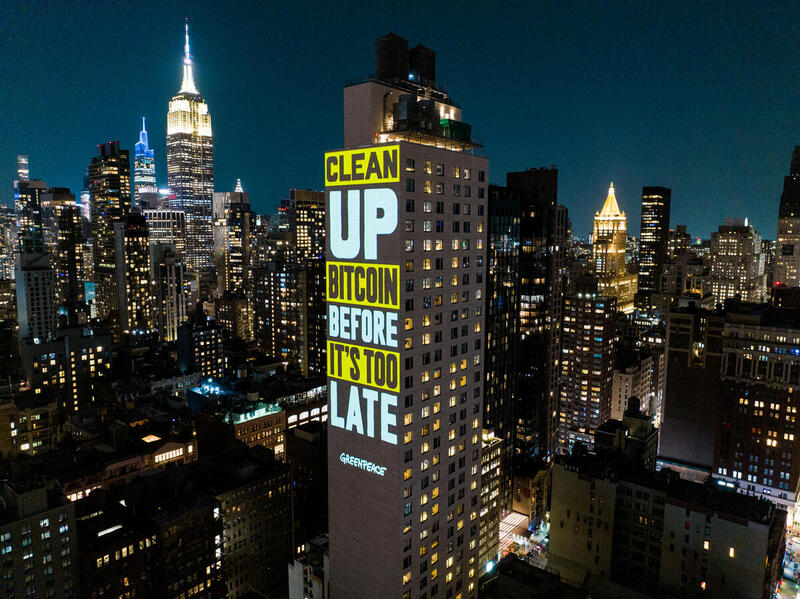

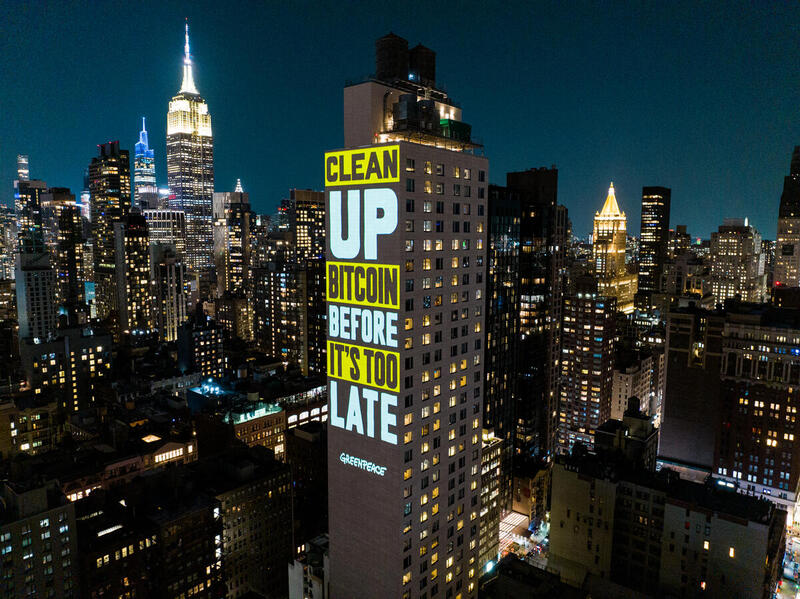

Washington, DC (August 30, 2023)–Yesterday, the U.S. Court of Appeals for the D.C. Circuit sided with cryptocurrency investment firm Grayscale Investments in a lawsuit against the Securities Exchange Commission (SEC), which had denied the company’s application to convert the Grayscale Bitcoin Trust into an exchange traded fund (ETF). The ruling will require that Grayscale resubmit their application and that it goes back to the SEC for review. In response to the decision, Joshua Archer, Greenpeace USA Bitcoin Campaign Lead, said: “This decision could pave the way for new investment products that further impede efforts to meet our climate goals. Before jumping on the Bitcoin ETF bandwagon, financial institutions need to do their due diligence on Bitcoin’s climate risk and its disastrous impact on communities. Bitcoin is using as much energy as entire countries, most of it derived from fossil fuels like coal, oil, and gas.”

In recent months, Bitcoin ETFs have been gaining momentum as a potential way for Bitcoin to become more mainstream, with devastating consequences for the planet. Recently, Jacobi Asset Managements attached an ESG label to a Bitcoin exchange-traded fund (ETF) listed in Europe, shocking environmental experts who have been sounding the alarm about Bitcoin’s energy-intensive mining process.

Jacobi claims that its ETF is compliant with EU rules about ESG investments based on purchasing renewable energy certificates (REC) to offset the emissions from the fund’s bitcoin holdings. In a recent Bloomberg article, Matthew Brander, a senior lecturer in carbon accounting at the University of Edinburgh Business School, says using RECs to fulfill a decarbonization strategy “isn’t credible.”

In response to Jacobi Asset Managements Bitcoin ETF, Archer said: “Attempts to label a Bitcoin ETF as an ESG investment are a deception. Buying a renewable energy certification doesn’t translate to a meaningful reduction in the environmental impact of Bitcoin mining and its substantial carbon emissions. It’s greenwashing and it fails to address the genuine challenges of decarbonization and cleaning up Bitcoin.”

As the SEC evaluates numerous applications for a spot Bitcoin ETF, it is imperative for regulators to tread with caution. The SEC’s decision to green light or reject a spot Bitcoin ETF in the U.S. should encompass a thorough evaluation of its potential climate impact and risks. Given the significant carbon footprint associated with Bitcoin mining, a comprehensive assessment of the environmental implications and climate risks should be taken into account while considering an ETF’s approval. Ignoring the broader consequences of such investments could risk perpetuating unsustainable practices and hinder the progress toward reducing climate destruction.”

###

Contact: Gigi Singh, Greenpeace USA Senior Communications Specialist, [email protected], (631) 404-9977

Greenpeace USA is part of a global network of independent campaigning organizations that use peaceful protest and creative communication to expose global environmental problems and promote solutions that are essential to a green and peaceful future. Greenpeace USA is committed to transforming the country’s unjust social, environmental, and economic systems from the ground up to address the climate crisis, advance racial justice, and build an economy that puts people first. Learn more at www.greenpeace.org/usa.