[voir l’article original en français]

After a long period of investigation and analysis, we reveal for the first time the hidden side of the financial industry of the Grand Duchy by providing figures on the environmental impact of its 100 largest investment funds in an unprecedented report: Investing in climate change – a climate analysis of the 100 largest investment funds in Luxembourg.

find here the full report

Today, the strategy of the 100 investment funds of the Luxembourg financial centre corresponds to a scenario of +4°C by 2050, which is a far cry from the objectives set by the Paris Agreement.

However, as Europe’s largest and the world’s second largest place for investment funds, Luxembourg could play a major role in the fight against climate change. For this to happen, its financial industry would need to make better investment choices. Although, the government and the financial sector have orchestrated a major communication campaign by presenting its financial centre as “a leading international platform for sustainable finance”, the reality is quite different: Luxembourg-based investment funds continue to inject billions of euros into fossil-fuel and other polluting companies, with a disastrous impact on the environment and the climate.

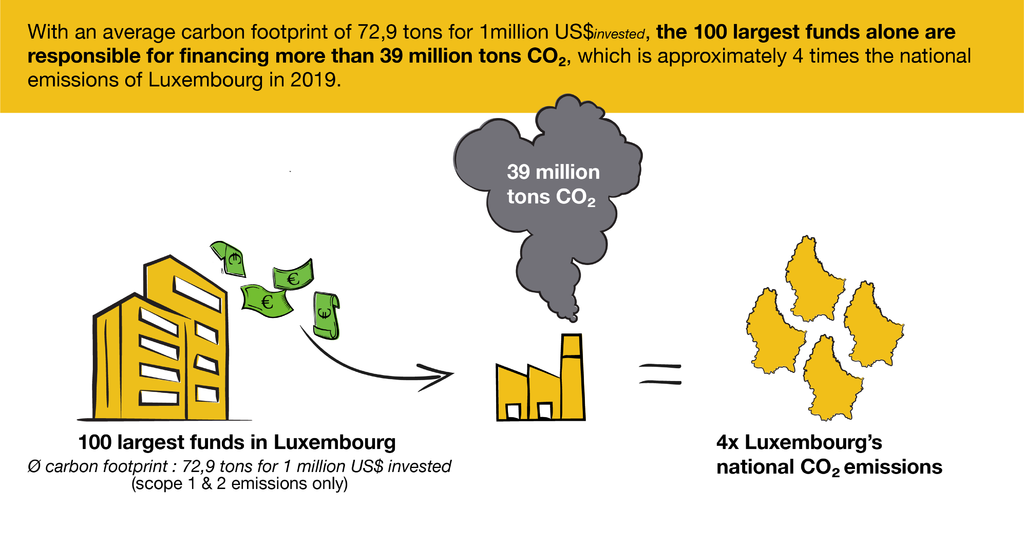

In this illustrated summary, we share with you the key figures to understand the impact of investments made from Luxembourg and how to reverse the trend to shift this money to renewable energy projects and green technologies.

The prevailing lack of transparency is coming to an end, it’s time to expose the role of the fund industry in the climate crisis: