Nowadays, it has been widely accepted as fact that climate change is one of the most significant threats to the environment and our planet. But the blame for global warming and climate destruction is still largely being placed unilaterally on traffic, factories and the like while ignoring one of the most significant culprits. Yes, fossil fuel companies are rightly denounced as climate villains, but those who are responsible for financing carbon-intensive industries are largely getting off scot-free: the financial industry.

A report published by Greenpeace Luxembourg on the climate impact of the 100 largest Luxembourgish investment funds revealed that these 100 funds on average invest in a way conducive to a 4°C increase in global temperature by 2050 – or even 6°C and more in some cases. According to the scientific consensus, global warming must be kept below 1,5°C to counteract the worst effects of climate change. The investment strategy of most of these funds doesn’t take into consideration the objectives of the Paris Agreement, either. The unavoidable transition to a low-carbon economy will thus prove to be quite the challenge for these funds, and put investors at risk of financial losses if or when the funds fail to adapt. Hence our demand for mandatory disclosure requirements of the carbon emissions bankrolled by financial actors and investment alignment with the objectives of the Paris Agreement.

As a reaction to Greenpeace’s report, the Association of the Luxembourg Fund Industry (ALFI) stated: “By 10 March 2021 at the latest, investment funds and asset managers must comply with the main provisions of the SFDR. All investment funds and sub-funds, in fact all financial products offered to retail and institutional investors, will be required to embed sustainability in some form and shape”. [1]

SFD-WHAT?!

The EU Sustainable Finance Disclosure Regulation – or SFDR – entered into force on 10 March of this year [2]. As a consequence, many financial market participants are now obliged to disclose whether they take into account the consequences of their investment decisions on the environment and social justice, both on an entity level and a product level (e.g. a fund), and what kind of actions they take to mitigate those impacts. As for the reason for implementing the SFDR, EU lawmakers stated that “investment decisions might be directly linked to negative material effects on the environment and society, regardless of whether the investment strategy of a financial market participant pursues a sustainable objective or not.” [3]

ALFI’s above-mentioned reaction implies that all is well now because financial actors will be obliged to disclose the environmental and social impacts of both their organisation and their products. The ALFI statement makes it sound as though Greenpeace’s demands have become obsolete now that the SFDR is in place, and that sustainability issues will be resolved thanks to the upcoming EU regulations on sustainable finance. Now, if you’re thinking “this sounds too good to be true”, you’re right…

Reality Check

Sure, it looks good on paper: lawmakers and fund managers can pat themselves on the back for being reactive, responsible and progressive – true role models for sustainable finance. When the SFDR entered into force, we at Greenpeace Luxembourg had a quick look online at what the managers of Luxembourg’s 100 largest investment funds had to say about committing to the goals of the regulation. And sure enough, they weren’t stingy with their assurances and self-praise.

PICTET Asset Management confirm that they “support[s] the goals of the SFDR and the wider EU Action Plan” [4] while BlackRock praise the SFDR as “a key catalyst to help advance sustainable investing in Europe” [5]. David Sheasby, Head of Stewardship and ESG at Franklin Templeton, seems to agree with his peers, saying that “SFDR is a key step in driving forward transparency and authenticity in how investors approach ESG and sustainability.” [6]

JP Morgan state that their “approach to markets and investments reflects our commitment to sustainability” [7], Goldman Sachs reiterate their “commitment to sustainable finance” [8], and Allianz Global Investors claim that “[r]esponsible investment is at the core of our DNA” [9].

If your head is spinning from all this candour and conscientiousness, please keep in mind that these asset managers are all part of the 100 Luxembourg funds analysed by Greenpeace. They have been found to be financing climate-damaging companies and ignoring the objectives of the Paris Agreement.

We had a closer look at the SFDR entity level statements of Blackrock, Pictet and JP Morgan. Sure, we found detailed explanations on how these companies integrate sustainability risks in their investment decision processes. However, in none of these statements, the fund managers declared if or how they want to align the investments of their funds with the objectives of the Paris agreement. So will SFDR all by itself stop investments into climate damaging companies ? To date, there is no evidence to support this blue-eyed belief.

Shifting the money

It is crucial to flip this ration and make sustainable finance the industry standard instead of a niche. After all, “making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development” is one of the three long-term goals of the 2015 Paris Agreement. According to the McKinsey report “How the European Union could achieve net-zero emissions at net-zero cost”, the EU needs EUR 28 trillion in investments in a number of key sectors (power, transportation, buildings, industry, agriculture and infrastructure) to achieve emission neutrality. Yet, according to the McKinsey report, nearly half of these investments are currently not profitable and as a result will be of little or no interest to companies and private investors, unless there is a fundamental shift in the policy environment.

Enter the EU Technical Expert Group on Sustainable Finance (EU TEG). The EU TEG is currently finalising its work on another element of the EU Action Plan on Sustainable Finance, the EU Sustainable Finance taxonomy. It is a classification system that is supposed to enable the categorisation of economic activities and sectors according to the role they play in sustainable development. Currently, the criteria for projects eligible under the taxonomy to qualify as “green” with regards to climate change mitigation and adaptation are being finalised. To be included in the proposed EU Taxonomy, an economic activity must contribute substantially to at least one environmental objective, and do “no significant harm” to the other five environmental objectives set out in the legislative proposal. [10]

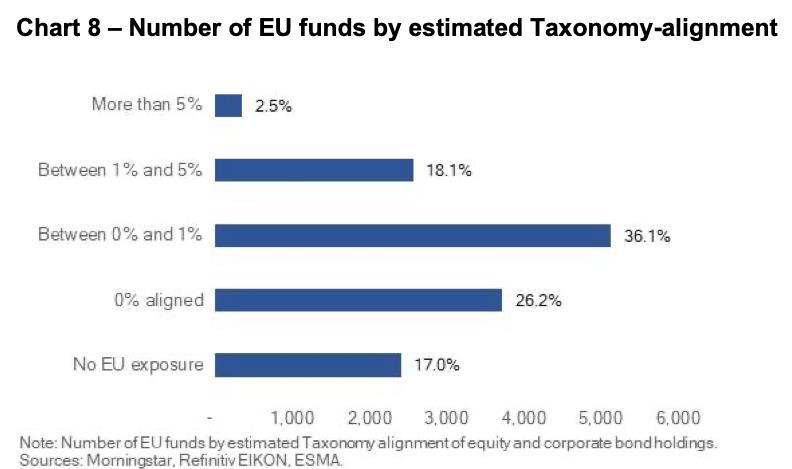

But the EU taxonomy is no silver bullet either. As stated in the Eurosif paper “The EU Taxonomy: fostering an honest debate”, “it is unlikely that alignment with the Taxonomy will be a material factor informing investment decisions in the near future. It is certainly not the case now: available data show that a large majority of sustainable/ESG funds currently marketed are initially not likely to have more than 10% of their portfolio aligning with the Taxonomy.”

In short, the EU taxonomy and SFDR alone will not lead to the substantial shift in investments that we need to fight climate change.

We need regulations with teeth!

Greenpeace welcomes the implementation of an EU-wide sustainability disclosure regulation for financial actors. However, empty phrases like the above-mentioned statements made by asset managers are not enough. And disclosing the sustainability impacts of a financial actor and its products as well as the action the financial player intends to take in order to mitigate its impact will not automatically resolve the climate crisis, nor any other environmental or societal problem. The finance sector needs to act! To be truly effective, the finance industry must demonstrate a commitment to bringing about real change.

Financial actors should be required:

- to make a clear commitment to achieve the Paris climate targets;

- to immediately create legitimate and extensive transparency regarding the sustainability performance of their products; and

- to expand their own methodological know-how in dealing with sustainability risks and to incorporate this into risk management and decision-making processes.

At the same time, the implementation of the SFDR does not mean that the Luxembourg government and financial authorities are absolved of their responsibility. They should help the financial actors in Luxembourg to align with the Paris climate objectives through a catalog of supporting measures and encourage the exchange of existing best practices and methodological know-how within the industry.

Today, the SFDR does not live up to its name. However, making an effort to prevent greenwashing and encourage sustainable finance is both a duty and an opportunity for the EU and national governments. Our financial stability and the protection of our planet depend on it.

[1] ALFI website

[2] suggested reading: “FAQ about the EU Sustainable Finance Disclosure Regulation”

[3] website of the European Commission

[4] PICTET Asset Management website

[5] BlackRock Frequently Asked Questions on SFDR

[6] Franklin Templeton: The Impacts of Sustainable Finance Disclosure Regulation on the European Distribution Landscape

[7] Morgan Stanley Environmental and Social Policy Statement

[8] Goldman Sachs 2019 Sustainability Report

[9] Allianz Global Investors website

[10] KPMG

Au Luxembourg, l’argent de nos cotisations sociales finance la destruction de l’environnement et du climat.

S'engager