Beijing – A Greenpeace East Asia analysis of newly-issued municipal bonds from provincial and municipal governments around China found that nearly one in five had unidentified medium to high potential for issuance as green municipal bonds1, reflecting a significant gap in leveraging finance resources to make local infrastructure sustainable and climate-resilient.

Greenpeace East Asia’s senior analyst Liu Wenjie (she/her) said:

“Despite a high percentage of municipal bonds with the potential to qualify in China, the issuance of green municipal bonds as a green financing mechanism is not being proactively pursued due to a lack of awareness and capacity to expand financial resources and instruments. This not only limits the financing available but also hinders the improvement of green projects. The green bond mechanism is there to ensure projects are truly climate resilient or low-carbon.”

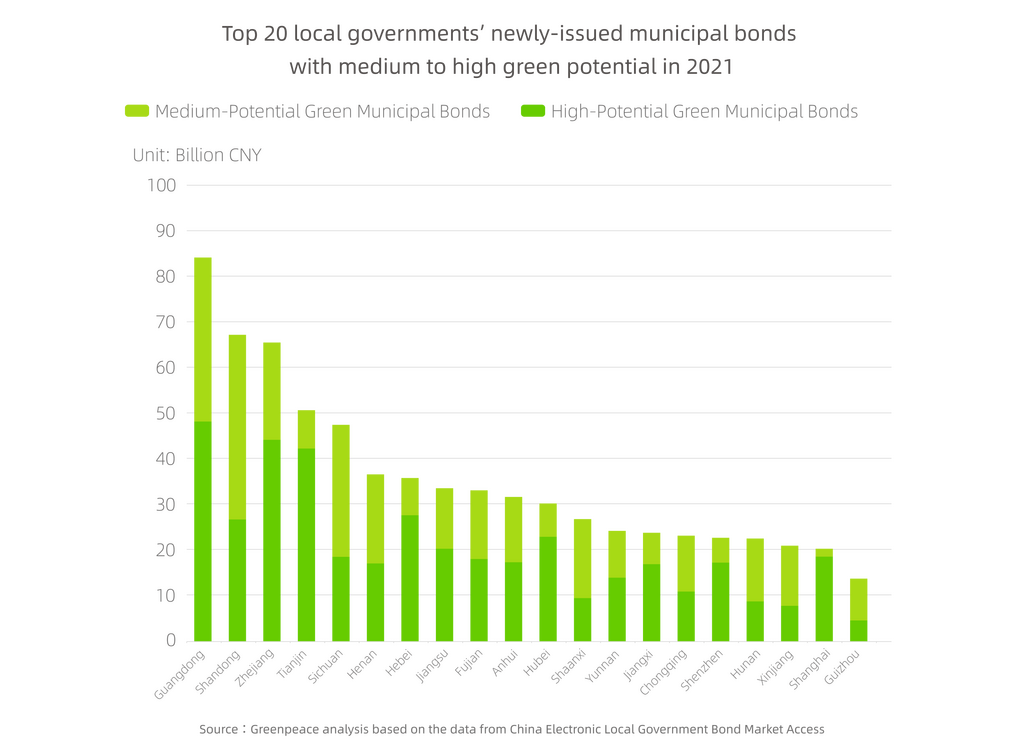

Greenpeace applied a framework based on ICMA’s Green Bond Principles and China’s Green Bond Endorsed Projects Catalogue (2021 Edition) to analyze the potential for the Chinese local governments to issue green municipal bonds and track the investment flows using more than 8000 municipal bond projects in 2021. The analysis finds that 19% of bonds have medium to high potential to pursue green bond certification, with a market size of more than 800 billion yuan. Currently, green municipal bonds only account for 1% of China’s total green bond market, according to the Climate Bonds Initiative.

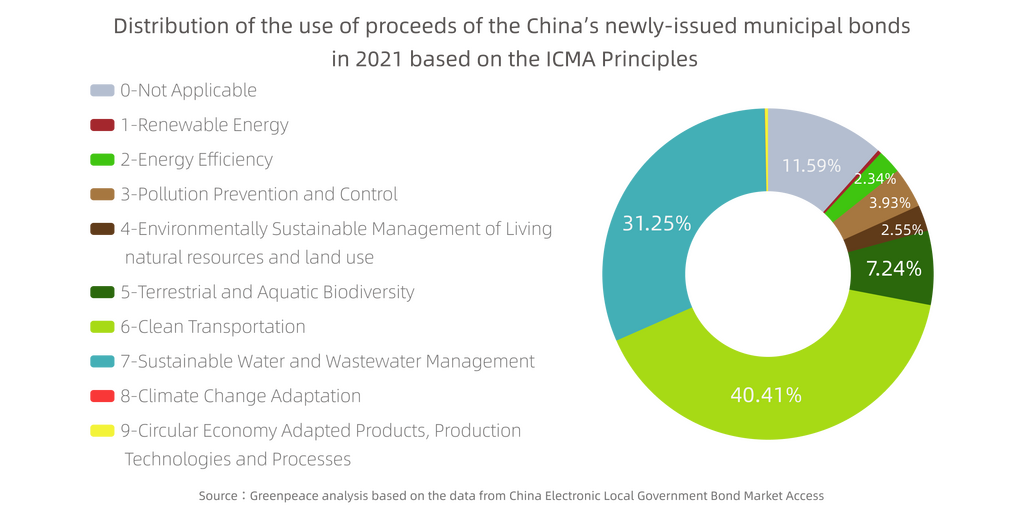

Of 2021 municipal bonds with “green” potential by ICMA standards, most were concentrated in two sectors: clean transportation, with 40.41%, and sustainable water and wastewater management, with 31.25%. Only 7.24% were relevant to biodiversity protection, 2.55% to environmental sustainability management, 3.93% to pollution prevention, 2.34% to energy efficiency, 0.36% to renewable energy, 0.31% to circular economy, and 0.02% to climate adaptation. Of 2021 municipal bonds with “green” potential by China standards, green infrastructure upgrading accounts for 38.36%, ecological environment industries account for 12.91%, and energy saving and environmental protection industries account for 7.74% respectively.

Liu said:

“Among local government projects that could qualify, the distribution of fund usage is imbalanced. In particular, local government projects currently have much more of a focus on mitigation than adaptation. Both are important. As extreme weather events in the background of climate change have happened more frequently in China in recent years, local governments should consider leveraging the green bond tool to invest in sustainable infrastructure and build climate resilience more systematically.”

The report also applied an input-output analysis for the newly issued municipal bonds in Zhejiang, Jiangsu, Guangdong, and Jiangxi to identify the co-benefits of economic growth, job creation, and emissions reduction. It finds that green investment can boost GDP growth equivalent to 2-3 times compared to the investment amount, create tens of thousands of jobs, and reduce carbon dioxide emissions by tens to millions of tons.

Estimated co-benefits of economic growth, job creation, and emissions reduction from municipal bonds with “green” potential in Zhejiang, Jiangsu, Guangdong, and Jiangxi

| Province | Estimated green investment vs added GDP | Estimated GDP added by green investment (billion Yuan) | Estimated jobs added rate from green investment | Estimated jobs added by green investment | Estimated carbon emissions reduction efficiency | Estimated carbon emissions reduction (10,000 tons) |

| Zhejiang | 1:3.16 | 40.42 | 0.06% | 56360 | 0.51% | 241.13 |

| Jiangsu | 1:2.41 | 10.81 | 0.09% | 12275 | 0.04% | 33.67 |

| Guangdong | 1:2.21 | 59.61 | 0.50% | 103011 | 0.28% | 191.32 |

| Jiangxi | 1:2.45 | 11.34 | 0.40% | 18140 | 0.21% | 48.68 |

Liu said:

“We estimated the co-benefits of projects that we could identify as within the parameters of what would qualify for green investment associated with municipal bonds. This is the low-hanging fruit of taking action on climate, but no one’s taking it.”

Greenpeace’s research suggests local governments in China should enhance regulations and standards for green municipal bonds, expand the issuance, and disclose the progress of projects and the use of proceeds to meet China’s “dual carbon” goals and expand investment and financing for sustainable infrastructure.

NOTES

- Green municipal bonds: In this study, it means local government bonds whose funds are mainly invested in green industries and related economic activities such as energy conservation and environmental protection, clean energy, green transportation, and green architecture based on green bond taxonomy.

END

Read the full report in Mandarin Chinese here.

For media enquiries please contact:

Qilin Liu, Greenpeace East Asia, Beijing, ([email protected])

Greenpeace International Press Desk, [email protected], +31 20 718 2470 (24 hours)