Tar Sands Tanker Superhighway Threatens Pacific Coast Waters

Published: 06-26-2018

Download: PDF

Summary Results

- The proposed Trans Mountain Expansion Project (TMEP) would increase the number of oil tankers carrying tar sands from Vancouver, Canada through the Salish Sea and down the Pacific Coast of the U.S.

- This report presents a map and analysis of 176 oil tanker and barge departures from the Westridge Marine Terminal in British Columbia from 2013 to the beginning of 2018.

- Over half (94) of those departures then sailed the length of the Pacific Coast to the port of Long Beach, California, with significant numbers heading to destinations in Washington State (36), the San Francisco Bay Area (23), and various locations in Asia and Hawaii (17).

- These results indicate that while the physical pipeline may stop at the water’s edge, a diluted bitumen spill remains a risk for coastal communities all along the Pacific Coast — from British Columbia to Washington to Oregon to California.

- Studies have estimated a 10%-29% chance of a “worst case” tanker spill (>100,000 barrels) over the next 50 years.

- The endangered Southern Resident orca population could be driven toward extinction by the increased ship noise, and risk of oil spills and ship strikes, resulting from TMEP.

- Coastal communities that rely on fishing and tourism have suffered billions of dollars in economic damages following previous catastrophic marine oil spills.

- The $60 billion coastal economy of Washington, Oregon and California currently supports over 150,000 jobs in commercial fishing and over 525,000 jobs in coastal tourism.

- In the British Columbia Lower Mainland, industries that rely on a clean coastline employ more than 320,000 people. Studies have found that a major oil spill in Washington would cost $10.8 billion, and one in Vancouver would cost $1.2 billion (CAD).

Introduction

The existing Trans Mountain pipeline currently transports ~300,000 barrels of oil per day (bpd) from Alberta, Canada, to the Pacific Coast. A majority of this oil arrives to refineries in Washington State via the Puget Sound Pipeline, but around 9-27% reaches the Westridge Marine Terminal (WMT) in Burnaby, British Columbia, where it is loaded onto oil tankers and barges for transport to refineries and other locations along the Pacific Coast and across the Pacific to Asia.[1]

The proposed Trans Mountain Expansion Project (TMEP) would expand the capacity of this system to 890,000 bpd,[2] and would increase the number of tankers leaving WMT by a factor of almost seven — from 5 per month to as many as 34 per month, or more than 400 a year.[3] Much of the oil transported by TMEP is expected to be diluted bitumen, or dilbit, extracted from Alberta’s tar sands.

While any oil spill into water is harmful and extremely difficult to clean up, the unique properties of dilbit could make clean-up even more difficult than a conventional oil spill.[4] Furthermore, dilbit is one of the most carbon-intensive fuels on the planet, with total lifecycle greenhouse gas emissions more than 30% higher than standard crude oil.[5] The tar sands are currently hampered by a lack of pipeline capacity and so the proposed construction of TMEP, Keystone XL and the Line 3 expansion pipelines could facilitate further investment in tar sands extraction and lead to greater global carbon emissions.[6]

Numerous reports have warned of the threat to the waters of the Salish Sea in British Columbia and Washington, and the Pacific Coast from increased marine shipments of tar sands oil.[7][8][9] Research has shown that since 2010, the U.S. Oil refinery in Tacoma, WA has received ~20 shipments of tar sands oil per year (>1.5 million barrels per year) via articulated tug barge (ATB)[10] traveling from WMT.[11][12] Other reports have found that much of the tar sands leaving the WMT is shipped by tanker to refineries in California that have capacity to process heavy crude oil.[13]

A movement to oppose the construction of TMEP has arisen, led by several First Nations who have emphasized their lack of consent for the project, inadequate consultation by the Canadian government, and violations of Indigenous sovereignty.[14] Recently, Trans Mountain pipeline owner Kinder Morgan reached a deal with the Canadian government to sell the existing pipeline for $4.5 billion (CAD) and build the TMEP. This deal allows Kinder Morgan to walk away but potentially leaves Canadian taxpayers on the hook for a troubled and controversial project.[15]

In this briefing, we present a visualization of 176 tar sands tanker (and some ATB) shipments leaving WMT from 2013 to 2018, showing the paths taken by those tankers down the Pacific Coast to refineries in the San Francisco and Long Beach areas.

Oil Tanker Traffic

The goal of this report is to illustrate which areas are at risk from increased tanker traffic and which destinations have received oil shipments originating from WMT. Using ship location data from the Automatic Identification System (AIS), we were able to identify 176 departures from WMT from January 2013 to February 2018.[16] In Figure 1, we map the tracks taken by those 176 departures from WMT to their next destination.[17]

As can be seen, the most popular destination for WMT tankers is the Long Beach area in California, followed by a number of destinations in the San Francisco Bay Area, Washington state, and a handful of voyages across the Pacific to various locations in Asia and Hawaii. The number of tanker tracks in this dataset for each destination is shown in Table 1.[18]

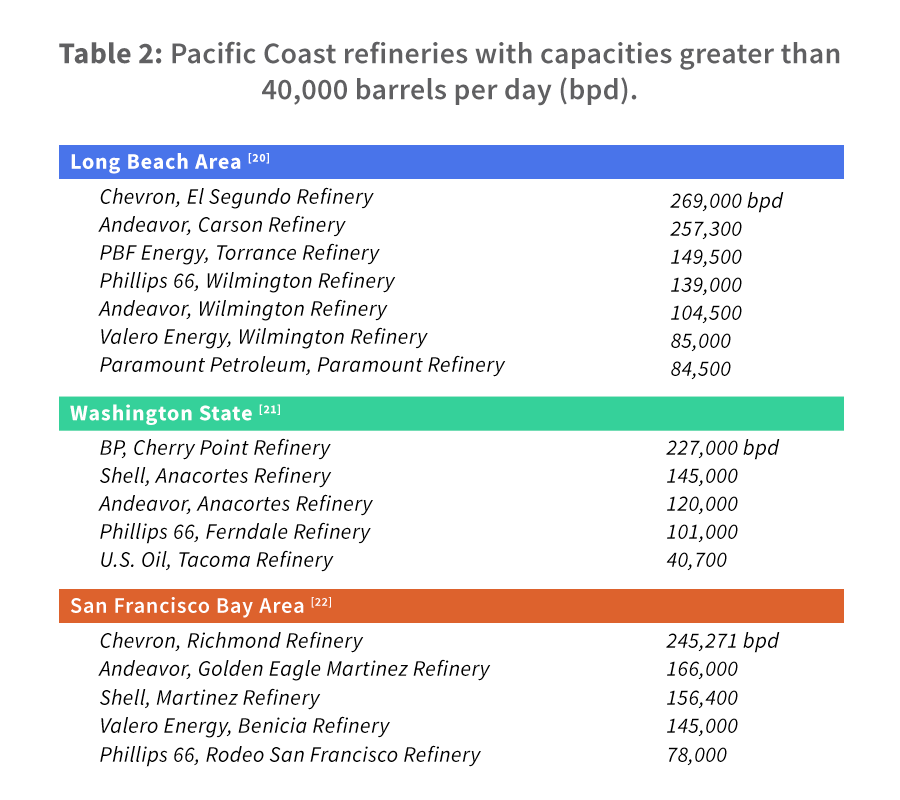

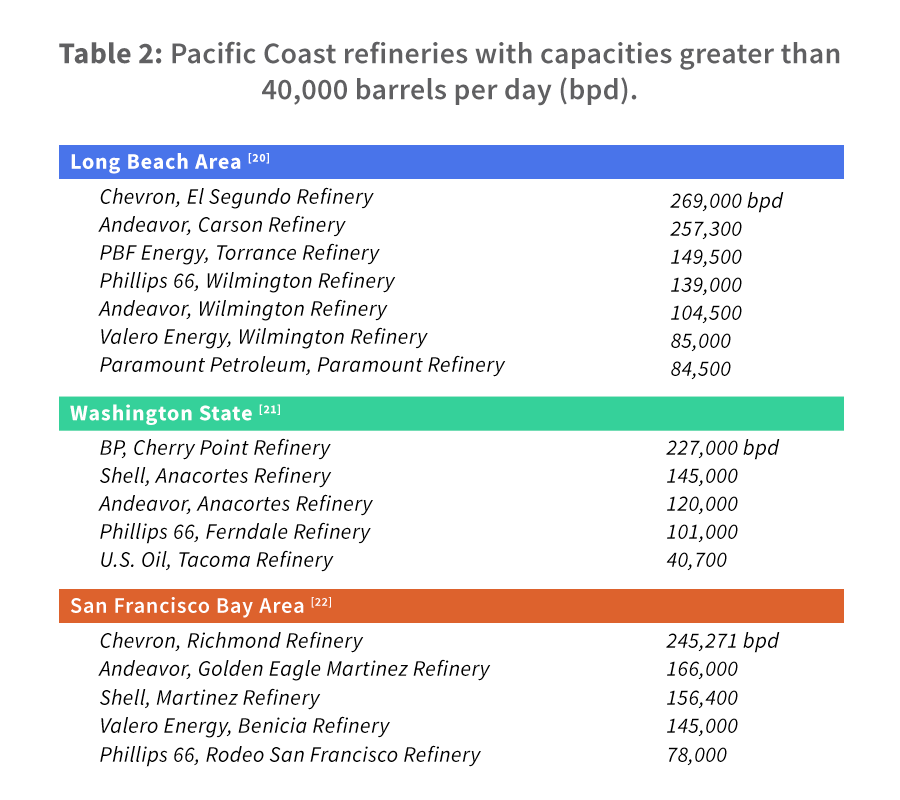

Virtually all of these WMT departures are bound for ports with significant refinery capacity nearby. At least one of these refineries — the Phillips 66 refinery in Rodeo — recently announced plans to expand its ability to accept and refine tar sands delivered by tanker.[19] Major refiners in these Pacific Coast port locations include:

The AIS data also clearly tracks the standard shipping channel that oil tankers (and all other large vessels) take when exiting the Salish Sea out the Strait of Juan de Fuca (Figure 2). The route heading to the Pacific Ocean shows several twists and turns as the tankers make their way around islands and through a number of narrow passages. Turn Point, entering the Haro Strait near San Juan Island, has been identified as a particular risk for a tanker accident.[23] ATB traffic heading to Tacoma takes a more easterly route through the Rosario Strait.

It is important to note that departures from WMT are only a fraction of the total tanker and ATB traffic through Washington and British Columbia waters. In 2017, there were 534 entering transits by tank ships through the Strait of Juan de Fuca (339 to Washington ports and 195 to Canadian ports) and there were over 1,000 ATB transits in Washington waters.[24]

Figure 3 shows the number of tanker departures in this dataset by destination for each year since 2013. This dataset shows a general decline in the number of tanker departures from WMT reaching a minimum in 2016 and rebounding in recent years. However, further research is necessary to determine whether this AIS data has captured all relevant tanker shipments, and to fully quantify tar sands shipments by barge or ATB, before firm conclusions about these trends can be reached.

Figure 4 illustrates the impact of an approximately seven-fold increase in tanker departures from WMT. The figure compares historical data from 2013 (52 departures) against simulated tanker tracks generated by randomly sampling from the historical AIS data points, and scaling the number of tracks per destination to match the estimated 34 departures per month.[25]

Risks from Tar Sands Shipments

A seven-fold increase in tar sands shipments leaving WMT translates into a significant increase in oil tanker traffic in B.C.’s Burrard Inlet, through the Salish Sea and down the U.S. Pacific Coast. Although the pipeline stops at the water’s edge in Burnaby, the risk from oil spills and other impacts does not.

Oil Spill Risk

Although stronger regulations appear to have reduced the rates of spills from oil tankers in the decades since the Exxon Valdez disaster,[26] catastrophic tanker accidents do still occur (e.g. the 2018 Sanchi tanker spill in the South China Sea)[27] and the Pacific Northwest has seen its share of devastating marine oil spills.[28]

Kinder Morgan’s own risk report estimated a “credible worst case” oil spill of 16,500 m3 (>100,000 barrels, or bbl) and an average spill case of 8,250 m3 (>50,000 bbl). This worst case volume was chosen to be larger than 90% of historical oil spills, but is smaller than the total volume of oil carried by tankers calling at WMT and is less than half the 260,000 bbl spilled by the Exxon Valdez in 1989. One analysis of these projections found a 10% chance of a “worst case” spill and a 42% chance of an “average case” spill in the next 50 years.[29] The areas along the route with the highest likelihood of a spill included Vancouver Harbor and Juan de Fuca Strait, while Turn Point in the Haro Strait was found to be the location with the “greatest level of navigational complexity for the entire passage.”[30] Stochastic modeling of a worst case spill at Turn Point found a high probability of oil reaching most of the Salish Sea and extending out into the Pacific.[31]

Independent risk analysis[32] and oil spill modeling[33] commissioned by the Tsleil-Waututh nation found that in 50 years there was a 79-87% chance of an oil spill at WMT or in Burrard Inlet. Over the 50-year time period, the study found a 37% likelihood of a large spill (>10,000 barrels) and a 29% chance of a “worst case” spill somewhere along the marine shipping route.[34] A “worst case” oil spill within Burrard Inlet would foul up to 25 kilometers of shoreline within 48 hours and potentially impact the health of up to a million people.[35] Of particular concern from a spill would be exposure to known carcinogens present in dilbit, including benzene and 1,3-butadiene.[36]

Economic Impacts from Oil Spills

The experience of communities impacted by the two largest U.S. offshore oil spills in recent years — the 1989 Exxon Valdez and the 2010 Deepwater Horizon disasters — show the high stakes for local coastal economies.

On March 23, 1989, the Exxon Valdez ran aground and spilled ~260,000 barrels of oil into Prince William Sound in Alaska. Fisheries were closed immediately following the spill, which caused an estimated $300 million in economic damages to ~32,000 people whose livelihoods depended on commercial fishing.[37] Salmon populations are now considered to have recovered, but the $8 million per year herring fishery collapsed in 1993 and has still yet to recover decades later.[38] There is debate about the causes of the collapse, but some local fishermen and scientists suspect the spill played a role. One study estimates the loss of the herring fishery has cost the region $1 billion.[39]

Although clean-up operations offered temporary support for the local economy, declines in tourism[40] and recreational fishing cost the state and local economy millions of dollars in the years following the spill.[41] Exxon ended up paying $3.8 billion in clean-up costs and damages, but waged a lengthy court battle to avoid paying additional punitive damages to local Alaskans harmed by the spill.[42] Monetary figures cannot fully encompass the “ecological, social, cultural, economic and psychological impacts on the residents of fishing communities and Native villages in Prince William Sound,”[43] and furthermore, there are still pockets of oil to be found in the region nearly 30 years later.[44]

In 2010, the Deepwater Horizon disaster spilled 4.9 million barrels of oil into the Gulf of Mexico closing many commercial fisheries and harming the Gulf Coast economy.[45] One study estimated closures affected more than 20% of the Gulf’s commercial catch and led to potential annual economic losses of $247 million.[46] Another study estimated the long-term losses from closed or degraded fisheries to be $8.7 billion through 2020.[47] Tourism losses (including “brand damage” due to the oil spill) through 2013 were estimated to be $22.7 billion.[48]

It is clear that the Pacific Northwest region and the U.S. Pacific Coast as a whole would have much to lose from a catastrophic oil spill in their waters. A study by Earth Economics found that ecosystem services within the Puget Sound Basin provided $7.4 to $61.7 billion in benefits every year — benefits that are being lost as the ecosystem is degraded.[49]

According to data from NOAA, commercial fisheries accounted for total sales of $21.3 billion (California), $1.7 billion (Washington), and $1.1 billion (Oregon) in 2015. Additionally, the seafood industry supported jobs totaling 114,000 (California), 23,000 (Washington), and 14,000 (Oregon).[50] In the region, Westport, WA, Astoria, OR, and Newport, OR, were ranked among the top ports nationally in terms of volume of seafood landed.[51] Tourism and recreation are also significant sources of employment and GDP along the Pacific Coast. Data from NOAA finds coastal tourism (including recreational fishing) contributed 420,000 (CA), 25,000 (OR), and 78,000 (WA) jobs, while generating $22.3 billion (CA), $1 billion (OR), and $4.1 billion (WA) in GDP, respectively.[52]

NOAA estimates the total ocean economy of the three U.S. states combined generates around $60 billion in GDP per year. The whale watching industry in Washington State alone is estimated to generate $65-$70 million per year and support around 40 whale watching companies.[53] In Vancouver, British Columbia, “ocean-dependent activities” are estimated to contribute “32,520-36,680 [person-years] of employment and $3,061-$3,261 million [CAD] in GDP” every year.[54]

Oil spills would threaten that economic base. The Washington State Department of Ecology estimates that a significant spill would “cost the state an average of $10.8 billion (based on 2006 estimates) and adversely affect 165,000 jobs.”[55] A ~100,000 bbl spill at the First Narrows in Vancouver would lead to economic losses in the range of $215-$1,230 million CAD and threaten 1,900-12,000 person-years of employment.[56] Another study found that industries that rely on the natural environment to support their brand and business “employ more than 320,000 people in the Lower Mainland” of British Columbia.[57] Smaller-scale studies of the impact of oil spills on local economies were carried out for Gray’s Harbor, WA,[58] and the Quinault Indian Nation.[59] These studies found that a range of oil spill scenarios could lead to hundreds of direct job losses, hundreds of millions of dollars in declining business revenues, and impacts on subsistence and treaty-protected resources.

Ship Noise & Orcas

The Southern Resident orca population is listed as endangered under the Endangered Species Act (ESA) in the U.S.[60] and under the Species at Risk Act in Canada.[61] More than 2,500 square miles of the Salish Sea, Puget Sound, and the Strait of Juan de Fuca have been designated as orca Critical Habitat under the ESA.[62] The Southern Resident population currently numbers 75 individuals, which represents a 20% decline over the past two decades.[63] Significant threats to the continued viability of this population include the availability of their preferred prey (Chinook salmon), ship traffic and noise (which can interfere with foraging for prey and communication), water contamination (pollutants from fish they eat accumulate in their blubber), and ship strikes.[64]

Southern Residents reduce their feeding activity by 25% when boats are present, and increased shipping traffic due to TMEP could lead to the “near continuous” presence of tankers in the area. A recent study found that the increase in these threats due to the construction of TMEP would have serious consequences for the orca population, with >50% chance that the orca population would fall below 30 individuals[65] — a level that would put the population on the road to extinction. Washington Governor Jay Inslee has spoken out against TMEP,[66] highlighting the devastating impact it could have on the Southern Residents, and has formed a task force to assemble a plan to recover the orcas and Chinook salmon.

Conclusions

If the Trans Mountain Expansion Project is built, the seven-fold increase in tanker traffic and the associated risks laid out in this report show clearly that the risks of this pipeline project don’t end at the water’s edge. The costs and risks of the Trans Mountain Expansion Project will be borne by First Nations, Indigenous, and other communities along the pipeline and tanker superhighway routes, as well as by the wildlife and ecosystems that will be impacted.

Any among the communities along the U.S. Pacific Coast could be threatened by this increase in oil tanker traffic. It is critical that — for the sake of the health and safety of our communities, local economies, ocean life, and our climate — the Trans Mountain Expansion Project be halted.

Appendix

Endnotes

1. Kinder Morgan. Product Destination. (link); City of Vancouver. What We Have Learned. (link)

2. Kinder Morgan. Project Overview. (link)

3. Kinder Morgan. Marine Plans. (link); Kinder Morgan. 2016. Marine Safety: Enhancements Already Underway in Local Waters. April 28. (link)

4. National Academies of Science, Engineering & Medicine. 2016. Spills of Diluted Bitumen from Pipelines: A Comparative Study of Environmental Fate, Effects, and Response. (link)

5. Carnegie Endowment. Oil-Climate Index. Viewing Total Emissions. (link) For example, comparing Canada Cold Lake CSS Dilbit against Saudi Arabia Ghawar oil.

6. Scott, A. & G. Muttitt. 2017. Climate on the Line: Why new tar sands pipelines are incompatible with the Paris goals. Oil Change International. January. (link)

7. Tsleil-Waututh Nation. Treaty, Land & Resources Department. 2015. Assessment of the Trans Mountain Pipeline and Tanker Expansion Proposal. (link)

8. Swift, A., D. Droitsch, & J. Axelrod. 2015. West Coast Tar Sands Invasion. Natural Resources Defence Council, NextGen Climate & Forest Ethics. April. (link)

9. Riordan, M. 2017. The Tar-Sands Threat to Northwest Waters. Sightline Institute, May 22. (link)

10. An ATB is a tug that is coupled to a barge via a notch at the stern that allows the tug to push and maneuver the barge rather than towing it with a cable. ATBs typically carry less oil than a tanker. See Felleman 2016.

11. Felleman, F. 2016. Tar Sands/Dilbit Crude Oil Movements Within the Salish Sea. Friends of the Earth. (link)

12. De Place, E. 2017. Is Canadian Tar Sands Pipeline Pointing to Tacoma? Sightline Institute, April 10. (link)

13. Axelrod, J. 2016. The Tar Sands Tanker Threat: American Waterways in Industry’s Sights. Natural Resources Defence Council. November. (link)

14. See for example: Secwepemcul’ecw Assembly. 2018. Trans Mountain Expansion Project and Investors Continue to Face Untenable Risk for Failing to Recognize Indigenous Jurisdiction. April 13. (link); Tsleil-Waututh Nation, Sacred Trust Initiative. (link); Treaty Alliance Against Tar Sands Expansion. (link)

15. Williams-Derry, C. 2018. Pipe Dreams: Canadian Government Bails Out Houston Billionaire. Sightline Institute, May 30. (link)

16. Historical AIS data purchased from Marine Traffic (link). See Appendix A for more detail on data analysis.

17. Vessel tracks cannot be perfectly represented with only a sample of AIS locations. The tracks in this report use ~20 points each and, as such, cannot perfectly capture every turn of the route. Some tracks seem to cross land due to a lack of data coverage for the entire route.

18. We categorize each vessel departure by its next primary port destination, as determined by Marine Traffic’s “next port” or “next call” fields, the AIS destination field, or analysis of the vessel track itself. This data is not sufficient to determine which refinery in the destination region (if any) was the recipient of the transported oil.

19. Communities for a Better Environment. 2018. Phillips 66 Co.’s San Francisco Refinery Tar Sands Oil Expansion in Rodeo, CA. April. (link)

20. California Energy Commission. California’s Oil Refineries. (link)

21. U.S. Energy Information Agency (EIA). 2017. Capacity of Operable Petroleum Refineries by State as of January 1, 2017. (link)

22. California Energy Commission.

23. Hunter, J. 2017. On the trail of an oil tanker. The Globe and Mail, November 12. (link)

24. State of Washington. Department of Ecology. 2018. VEAT 2017: Vessel Entries and Transits for Washington Waters. March. Publication 18-08-001. Tables 1 & 2. (link)

25. See Appendix A for more information on how these simulated tracks were generated.

26. International Tanker Owners Pollution Federation (ITOPF). Oil Tanker Spill Statistics 2017. (link)

27. Arranz, A., M. Duhalde, M. Hernandez, P. Robles, D. Wong & D. Long. 2018. An invisible threat: How the Sanchi oil tanker environmental disaster unfolded. South China Morning Post, January 18. (link)

28. De Place, E. 2015. Fifty Years of Oil Spills in Washington’s Waters: What can the past tell us about the future? Sightline Institute, January 12. (link)

29. Foschi 2014, as cited in Lacy et al. 2016. Report on Population Viability Analysis model investigations of threats to the Southern Resident Killer Whale population from Trans Mountain Expansion Project. Rainforest Conservation Foundation. (link)

30. Det Norske Veritas. 2013. Termpol 3.15 – General Risk Analysis and Intended Methods of Reducing Risks. Trans Mountain Expansion Project. Prepared for Trans Mountain. (link)

31. Lacy et al. 2016. Figures 6 and 7.

32. Gunton & Broadbent. 2015. An Assessment of Spill Risk for the Trans Mountain Expansion Project. May. (link) Included as Appendix 1 of Tsleil-Waututh Nation. 2015.

33. Genwest Systems Inc. Oil Spill Trajectory Modeling Report in Burrard Inlet for the Trans Mountain Expansion Project. (link) Included as Appendix 2 of Tsleil-Waututh Nation. 2015.

34. Tsleil-Waututh Nation. 2015.

35. Tsleil-Waututh Nation. What would the impact of an oil spill in Burrard Inlet be? (link)

36. Public Health Association of British Columbia. 2017. Letter to The Honourable Mary Polak, Minister of Environment, Re: The Approval of the Expansion of the Kinder Morgan Trans Mountain Pipeline. January 30. (link)

37. Murray, S. & J. Short. 2014. 25 Years Later: Why Alaska Can’t Afford Another Exxon Valdez. Huffington Post, March 23. (link)

38. Exxon Valdez Oil Spill Trustee Council. Commercial Fishing. (link)

39. Rosen, J. 2017. Boom and Busted: Lessons from Alaska’s Mysterious Herring Collapse. News Deeply, October 13. (link)

40. Exxon Valdez Oil Spill Trustee Council. Recreation & Tourism. (link)

41. Exxon Valdez Oil Spill Trustee Council. Economic Impacts of the Spill. (link)

42. Struck, D. 2009. Twenty Years Later, Impacts of the Exxon Valdez Linger. Yale Environment 360, March 24. (link)

43. Picou & Martin. 2007. Long-Term Community Impacts of the Exxon Valdez Oil Spill: Patterns of Social Disruption and Psychological Stress Seventeen Years after the Disaster. (link)

44. Exxon Valdez Oil Spill Trustee Council. Lingering Oil. (link)

45. Adams, A. 2015. Summary of Information concerning the Ecological and Economic Impacts of the BP Deepwater Horizon Oil Spill Disaster. Natural Resources Defence Council, June. (link)

46. McCrea-Strub et al. 2011. Potential impact of the Deepwater Horizon oil spill on commercial fisheries in the Gulf of Mexico. Fisheries, 36:7, 332-336, DOI: 10.1080/03632415.2011.589334. (link)

47. Sumaila, et al. 2012. Impact of the Deepwater Horizon well blowout on the economics of U.S. Gulf fisheries.

Canadian Journal of Fisheries and Aquatic Sciences, 69:3, 499–510. (link)

48. Oxford Economics. Potential Impact of the Gulf Oil Spill on Tourism. A report prepared for the U.S. Travel Association. (link)

49. Batker et al. A New View of the Puget Sound Economy: The Economic Value of Nature’s Services in the Puget Sound Basin. Earth Economics. (link)

50. NOAA Fisheries. 2017. Fisheries Economics of the United States, 2015. pp-40-41. (link). Jobs and sales numbers include imports, which represent a significant fraction of the totals for California.

51. National Marine Fisheries Service. 2018. Fisheries of the United States, 2016. (link)

52. NOAA. Economics: National Ocean Watch. ENOW Explorer. (link)

53. Southern Resident Killer Whale Chinook Salmon Initiative. Economic Value: Endangered Southern Resident Killer Whales Add Minimum of $65-$70 Million to Washington State’s Economy—They Would Be Missed. (link)

54. Bjarnason, H., N. Hotte & U.R. Sumaila. 2015. Potential economic impact of a tanker spill on ocean-dependent activities in Vancouver, British Columbia. Fisheries Economics Research Unit, UBC Fisheries Centre, May 20. (link)

55. Department of Ecology. State of Washington. Oil spill prevention in Washington. (link)

56. Bjarnason et al. 2015.

57. Conversations for Responsible Economic Development (CRED). 2013. Assessing the risks of Kinder Morgan’s proposed new Trans Mountain pipeline. May. (link)

58. Resource Dimensions. 2015. Economic Impacts of Crude Oil Transport on the Grays Harbor Economy. April. (link)

59. Resource Dimensions. 2015. Economic Impacts of Crude Oil Transport on the Quinault Indian Nation and the Local Economy. April. (link)

60. U.S. Fish & Wildlife Service. ECOS. Species Profile for Killer Whale (Orcinus orca). (link)

61. Fisheries and Oceans Canada. Killer Whale (Northeast Pacific, southern resident population). (link)

62. NOAA Fisheries. Critical Habitat for Southern Resident Killer Whales. (link)

63. Center for Whale Research. Southern Resident Killer Whale Population. (link); Rosenberg, M. 2018. Orca death brings southern resident whale population to lowest level in 34 years. Seattle Times, June 16. (link)

64. NOAA Fisheries. 2018. Saving Southern Resident Killer Whales. (link); NOAA. Saving the Southern Residents: Turning the Tide for the West Coast’s Beloved Killer Whales. (link)

65. Lacy et al. 2016.

66. Inslee, J. 2018. Canada’s unneighborly pipeline deal threatens orcas and climate. Seattle Times, May 30. (link)